The build up to results day has been an emotional rollercoaster with lots of ups and downs. And with the day finally done and dusted (phew!) you’re probably wondering about what comes next. Whether your teen’s place on a uni course is sorted, or they’re still working out their options through Clearing, student finance might be on your mind. With the cost of living going up (and up), it’s normal to worry about how to help your child cover all the costs. Things can add up pretty quickly with tuition fees, textbooks, daily costs and rent. But there are ways you can still make it work. Here, we break down everything about uni costs, and different routes you can take to finance their undergrad degree.

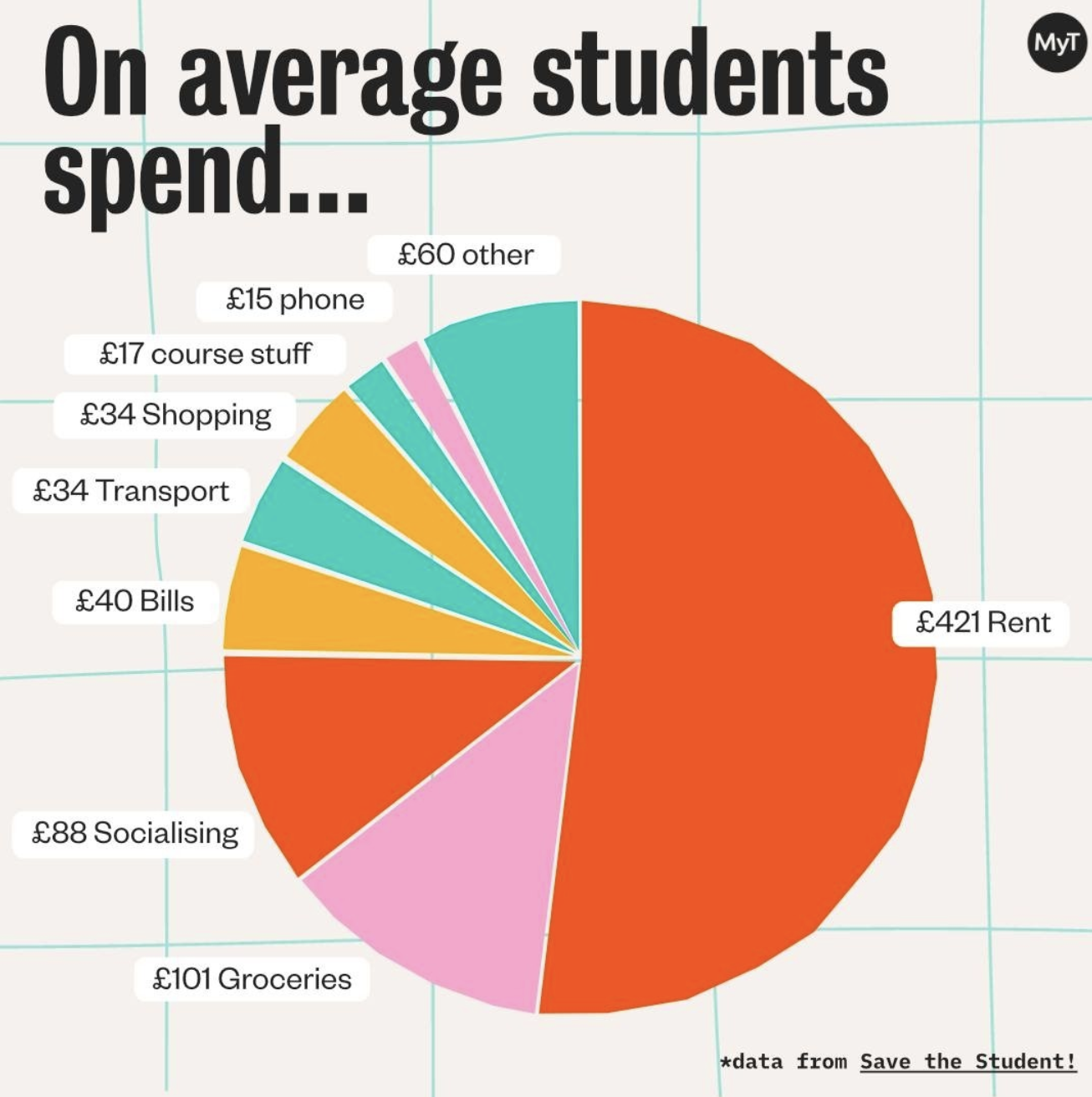

How much do students spend?

Seeing what their cost of living will be as a student can be helpful in planning ahead. We’ve put together a monthly breakdown of the average student spend. Of course, this will be different depending on where you go (plus inflation rates going up month-by-month). For example, rent in London will be more expensive than in Belfast. A 2022 survey from Save The Student (that includes more than 2000 students from across the UK) shows that the average student spends about £800 a month on living expenses.

Tuition fees in the UK

First thing’s first– what kind of figures are we looking at? Well, right now, most unis charge £9,250/year in England. But in Scotland, Northern Ireland, and Wales, this can be a lot less– and even cost nothing for students who already live there. So it’s worth bearing in mind when they’re deciding on where to study.

If they’re an international student, usually the fees will be a lot higher than £9,250. At least there are scholarships specifically earmarked for those students.

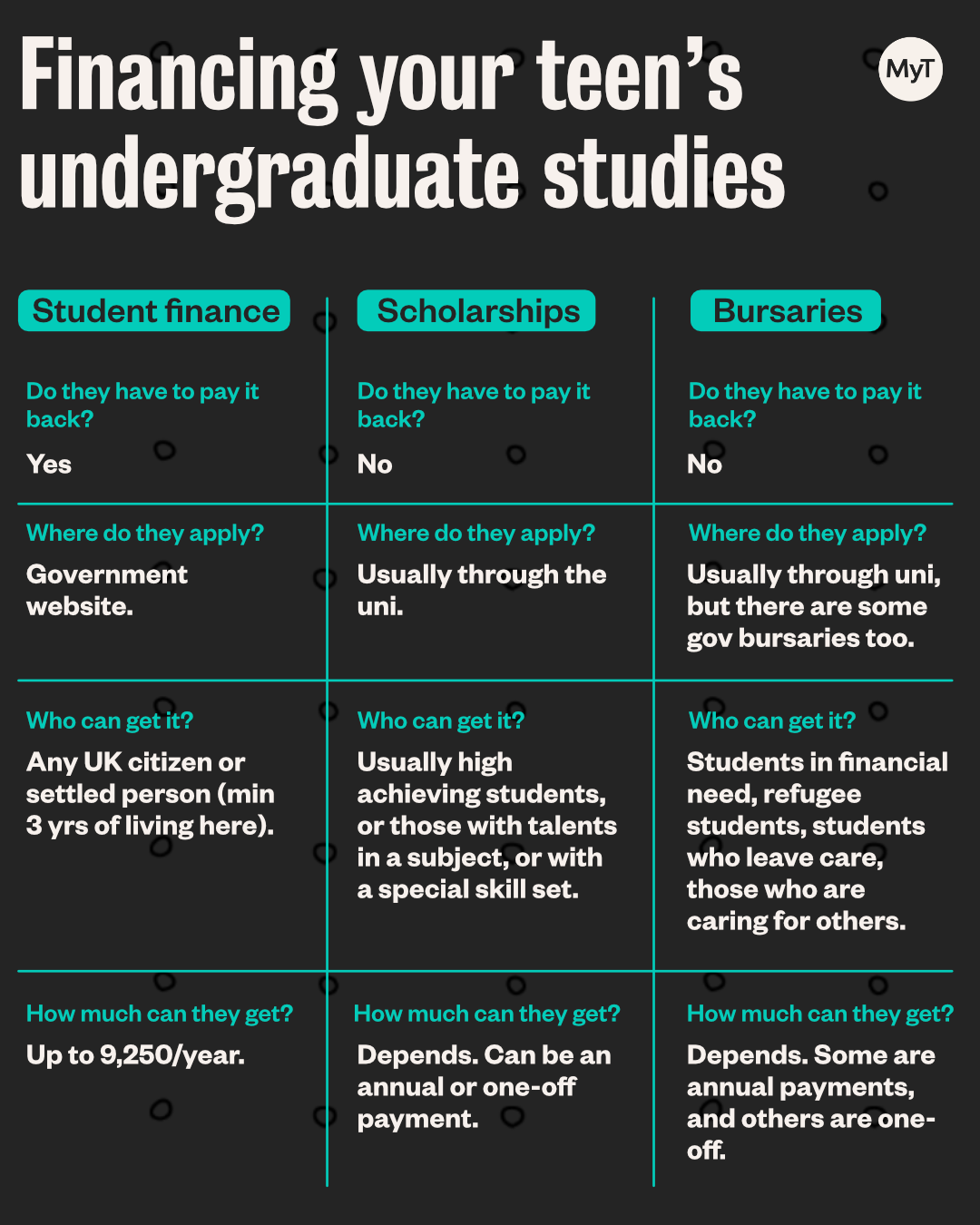

4 ways to finance your child’s studies

1. Student Finance–tuition fee and maintenance loans

What is the tuition fee loan?

This is a loan funded by the government. It gives students from any financial background a hand with their tuition. So even if you are earning a lot–your teen can still get a loan.

What is the maintenance loan?

The maintenance loan is also money they can borrow from the government. It helps them pay for day-to-day things like food, rent, books, bills. Your teen will get the money straight into their account each term (it’s monthly for Scotland). It’s up to them to decide how they’ll spend it, but it’s a good idea to come up with a monthly budget plan. That way, they won’t be stuck at the end of the month with bills to pay, and no money!

Who can get tuition fees and maintenance loans?

There are lots of rules, but your teen should be able to get tuition and maintenance support as long as…

- The uni where they want to study at offers a qualifying course

- Their course is recognised (you can double check with the uni or college)

- They’ve never studied this degree before

- They’re a UK citizen. If they’ve got a ‘settled’ status, they’ll need to have lived in the UK for at least 3 years before their course starts.

How much can they borrow?

For the tuition fee loan, how much your teen can borrow depends on a few things. Like if they’re a part-time or full-time student, and whether their course is at a public or private uni. But as a full-time student at a public university, they can borrow up to £9,250 in England. And if they’re studying an accelerated degree course (courses that take 2 years to finish vs the usual 3 or 4), they can borrow up to £11,100.

For the maintenance loan (that helps fund your living costs), how much they get depends on what you (as their parent) earn. You might be expected to chip in if you’re making above a certain amount.

How do they apply?

They can apply online for the tuition and maintenance loans on the government website.

What happens after they’ve finished my degree?

When your teen’s graduated and they’re working in a job where they’re earning a salary, they’ll have to start repaying their student loans. Right now, the interest rate on student finance loans are about 4.5%, but this might go up to 7.3% for some students. How much they have to pay back actually depends a lot on their future salary. So if they’re not earning a lot, they might only have to pay back a small amount of what they borrowed– and in some cases, student loans can be written off too.

Another key part of repayments is what sort of Student Loan plan they’re on. This depends on when they studied and which country gave them the loan. Here you can find out all about repayments for Plans 1, 2 and 4.

2. Bursaries

What are bursaries and who are they for?

Bursaries are paid by the university or college where your teen studies. They don’t have to pay them back!

They’re usually given to students whose parents earn below £25,000, but at some unis, this can be £40,000. Bursaries are also for students who are refugees, or those who’ve been in care, or who are looking after others as their primary carer.

How much can they get?

This depends on the uni or college where your teen’s studying. They might be one-off payments of £2000 for example, or yearly payments of £1000 or more. Usually, this money helps pay for living costs, like food, books, rent.

Where do they apply?

Your teen can apply via the uni or college where they plan to study.

3. Scholarships

What are scholarships and who are they for?

Scholarships usually reward academic achievements, or talent in areas like the Arts or sports. Sometimes they’re course-specific. So, for example, there’s a big drive to get more STEM (Science, Technology, Engineering, Maths) teachers in the UK. And because of this, your teen might come across teaching scholarships if they want to train in STEM subjects.

Every uni and college will have their own specific scholarships. The good news is that like bursaries, they don’t have to pay scholarships back!

How much can they get?

Again, this completely depends on the scholarship. Some pay for your teen’s tuition, or others are cash payments that they can use towards their living costs and tuition. And like bursaries, they might be one-off payments or annual.

It’s a good idea to have a look at what scholarships are on offer when your teen is looking at different uni options.

Where do they apply?

They’ll usually apply through the uni and college where they plan to study.

4. Their own own money

Every little bit helps! Your teen can start saving money now with a part-time job, and work while they study to help pay for living costs.

There are usually campus jobs they can apply to, or they can work as a tutor for us. Being a tutor means they can pick their own hours and take on as many students as they want, and fit their tutoring sessions around their busy schedule.

When they’re in a tight spot

If your teen gets a student bank account, they can get interest-free overdraft. That means if they need money fast, they can get it from their student overdraft (some have limits of up to £3000). It’s better not to be in this situation by helping them put a budget together so that your teen keeps track of money going in and out every month.

To sum up…

Of course, if you’re in a position to help them financially, then that’s great. But don’t tell yourself that it’s the only way they can get by! Even if you can’t support them at uni, you can still help them with advice at the end of the phone, budgeting tips, easy recipes (and much more).