If you’ve started uni this year, you’ll probably want to open a student bank account. You might be wondering how it could be so different from the one you already have. The best student accounts offer big interest-free overdrafts, free gifts when you join and good overseas withdrawal deals. Budgeting as a student is tricky too – now’s the time to learn money management skills for life! And with the right bank you get extra support with awesome apps that help you budget, save and keep track of your money too.

Managing your money at uni isn’t always easy

- How is a student account different from a regular current account?

- What’s an overdraft?

- What is AER mean?

- What is cashback?

- What do I need to open a student account?

- When do I have to pay back my overdraft?

- Should I make savings as a student?

- Which is the best bank for me?

How is a student account different from a regular current account?

Student current accounts are designed mainly to help with tricky cash flow i.e. when you have more cash going out of your account than going in. This happens easily for students who have to pay house deposits and other expenses often all at once (at the start of term) before you get the chance to. From the banks’ perspectives, they also want to get you to join them now, with the hope that you’ll stay with them for the rest of your life. Sneaky, eh?

What’s an overdraft?

If you’re not sure and have been afraid to ask, you might be wondering what we mean by overdraft (hint: it’s a word you’ll be hearing a lot of in the next few years). An overdraft is the amount of money you’re allowed to use (or overdraw) if yours runs out. Banks can also refer to it as a “planned overdraft” which is the amount you agreed with them (if you overspend you can accidentally go into your “unplanned overdraft”, for which you’ll normally get fined around £5 a day or more).

Top tip: if you’re feeling savvy and get a bigger overdraft than you need to live on, you can transfer your overdraft money into a savings account to earn some interest off that. Literally free money!

What is AER?

If you’re looking at the different account options out there, you might be seeing the term “AER” used a lot. This stands for Annual Equivalent Rate, and AER interest is the percentage of your money that you’ll earn from the amount in your account. Lots of banks don’t offer AER interest for student accounts, but some do to offer the competitive edge against other banks.

What is cashback?

Cashback is when a bank (or credit card provider) gives you a percentage of your spend back to you. Sounds pretty sweet, right? But why would a bank be so kind? Partially, they can make money on the transaction costs from the businesses where you’re shopping, so the cashback encourages you to spend with them and they’ll still make a profit. It’s also a way to incentivise you to bank with them as a student, with the hope that you’ll stay with them forever.

When do I have to pay back my overdraft?

Although it’d be nice to get given free money forever from your bank, sadly that’s not how it goes. Banks have different payback schemes that start after you graduate (sometimes straight away, sometimes a year or two after). So although graduation can seem like a lifetime away, it’s really not, and you should weigh up payback schemes as well as what you’ll get now.

Should I make savings as a student?

Managing your money for the first time as an adult can be really hard. What sounds like loads of money at the start of term can go extremely quickly on meals, drinks and lots of other small things if you’re not careful. So if your focus is mainly on not running out of money, the idea of making savings can sound like a fantasy.

Although it’s easier said than done, you can save yourself a lot of stress if you put aside even a tiny amount each month. A great way to stay on top of your finance without getting into even more debt is to find a part-time job. One of the best money-earners as a student is tutoring – it’s relevant to your studies, it can open up other career paths, and you can earn much more per hour, so you’ll have more time to focus on your all-important studies too.

Which is the best bank for me?

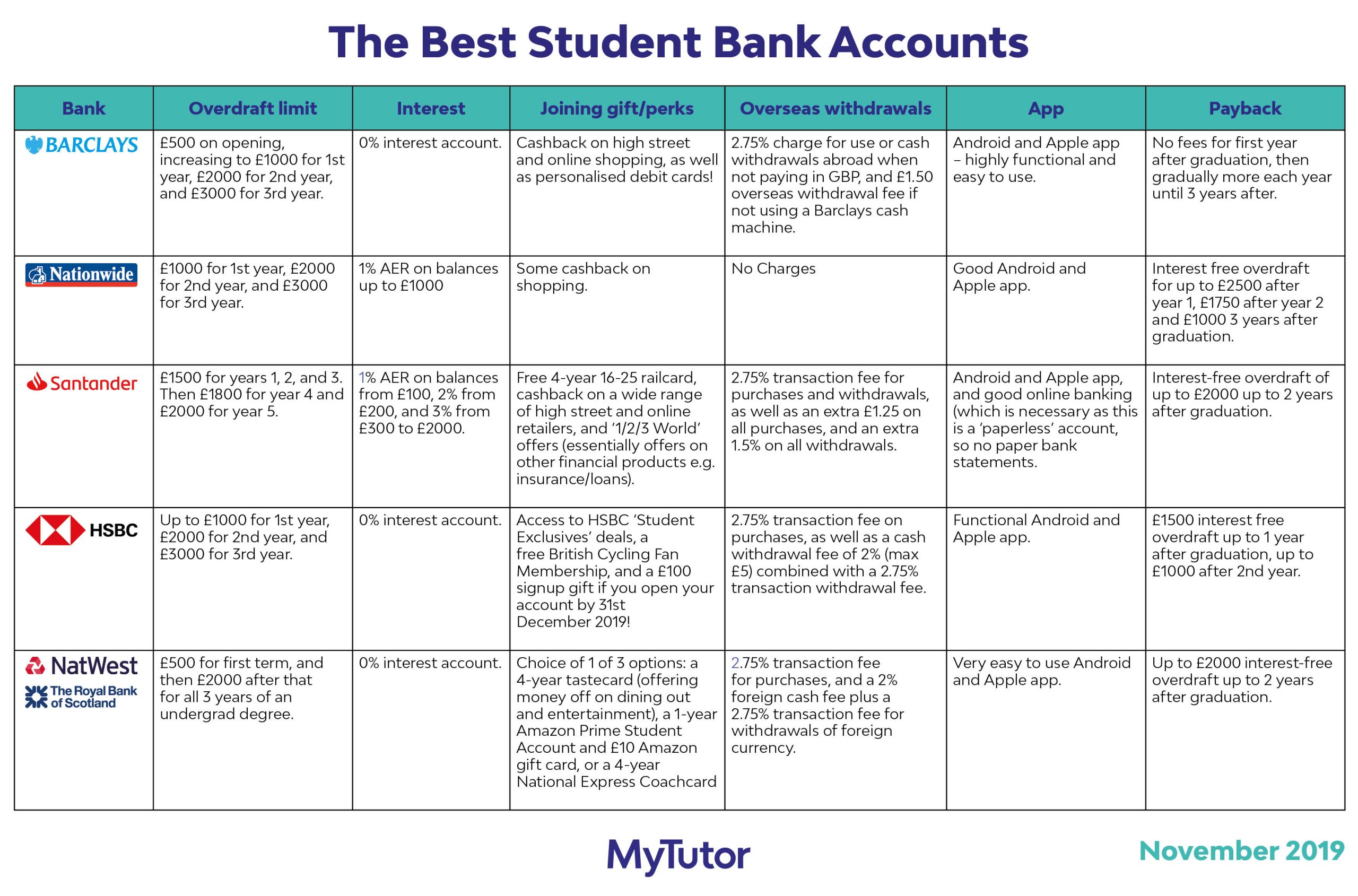

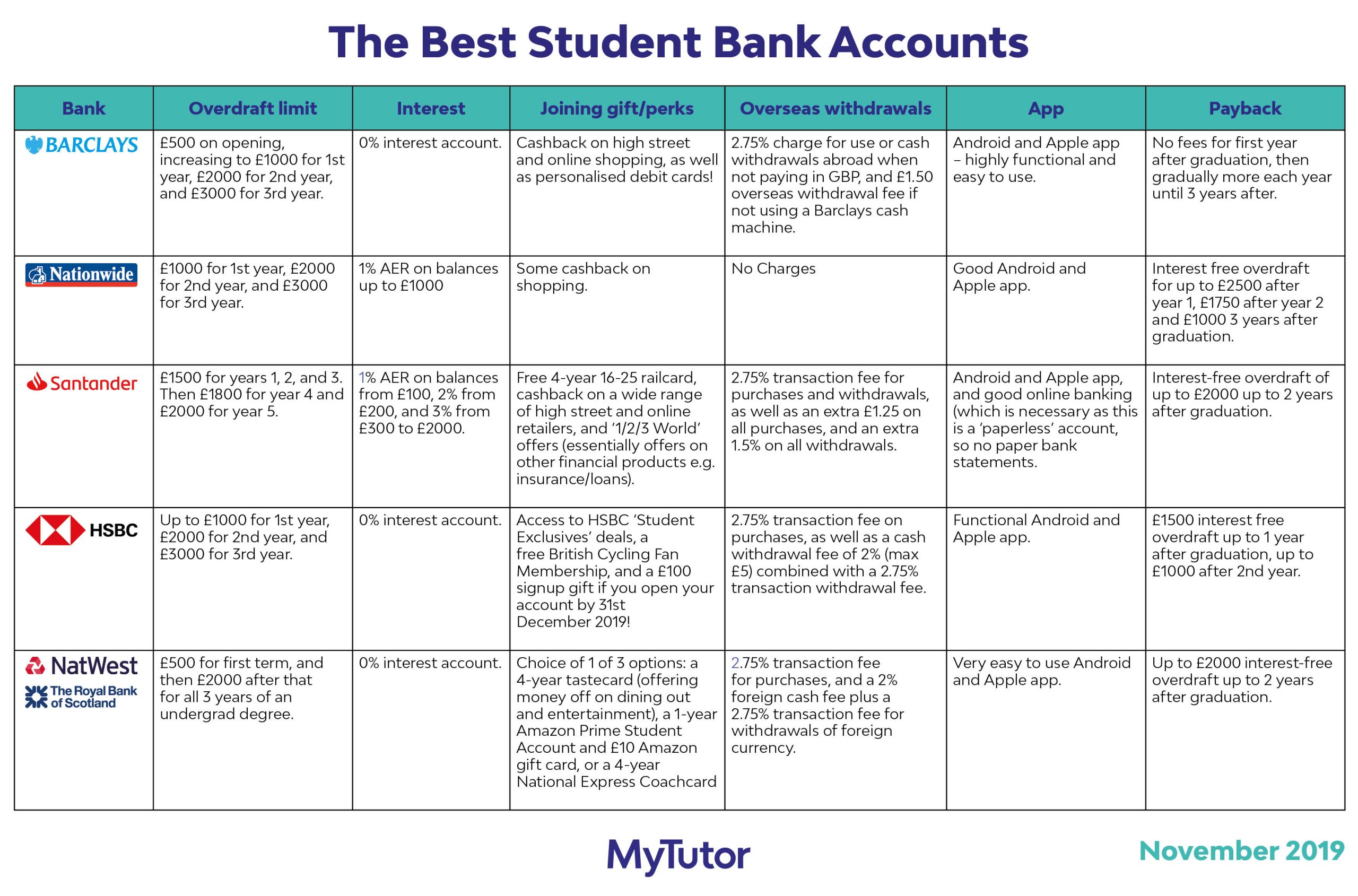

All the banks that offer student accounts have their own set of pros and cons, and it can seem impossible to choose. Here we’ve compiled a list of our top 5 student bank accounts to help you choose.

Barclays

Overview: Barclays is a reliable, solid and popular choice among students, offering good perks and a generous overdraft limit. It has friendly customer support and a great app that helps you keep aware of what you’re spending too.

Pros: High overdraft limit (particularly in 3rd year), good cashback perks and easy-to-use online banking. Customer service is also generally very good.

Cons: No interest on balance, and overdraft might be too low (£1000) for some people in first year.

Nationwide

Overview: Nationwide’s ‘FlexStudent’ not only offers a highly competitive overdraft, but is also one of the few student accounts that offers interest on your account balance, and is the only of our 5 accounts to have no overseas charges.

Pros: Generous overdraft limit, interest on balances up to £1000, and no overseas transaction fees (perfect for holidays or “research trips”).

Cons: no real extra perks or benefits (apart from some undefined cashback on purchases).

Santander

Overview: While not having the highest undergraduate overdraft limit, Santander’s 123 Student account is good for those studying longer degrees like Medicine or Engineering as the overdraft options for years 4, 5 and 6 are much better than most competitors. It also offers a wide range of perks, and has a comparatively high variable interest rate on your balance.

Pros: Very good graduate overdraft limit, high interest rate for this type of account, and wide range of extra benefits (with the free railcard being a very appealing option if you travel a lot by train).

Cons: Overdraft isn’t as high as some other accounts for undergraduates, and overseas fees are higher than competitors.

HSBC

Overview: The HSBC student account has a high overdraft limit (especially in 3rd year), and some very competitive joining gifts. The bank also offers a student credit card, which can be a really useful tool for some students to borrow money and increase their credit rating, though this is separate to this account.

Pros: High overdraft, great perks like their £100 joining gift and, for the sporty ones out there, a British Cycling Fan Membership.

Cons: Fairly high overseas fees and 0% interest on savings.

NatWest/RBS

Overview: You might be wondering why NatWest and Royal Bank of Scotland have been paired together – well, it’s because they are exactly the same. NatWest is part of the Royal Bank of Scotland Group, so even though these accounts come from different banks, they offer exactly the same deal, and it’s a good one, with a fixed £2000 overdraft for all 3 years of your degree, as well as a nice choice of joining gifts, and very good app and online banking services.

Pros: Good overdraft (especially for first year) and a nice selection of joining perks.

Cons: 0% interest and high overseas withdrawal fees.

And here’s a table to help you compare and choose. Click here to see the downloadable version.

What do I need to open a student bank account?

After you decide which bank to open an account with, you’ll need to make an appointment with them. You can do this on the phone, or go into your local branch to find a time. When you go to your appointment, you’ll need to take with you the following:

- Proof of id (passport or drivers licence)

- Proof of address (bank statement, utility bill or another official document with your name and address on)

- Proof of student status (your university acceptance letter or a UCAS letter)

How do I choose my student bank account?

The best bank for someone else might not be the best bank for you. As you can see, these accounts do vary a fair bit in terms of what they offer, so it’s important when choosing one to pick the one that will best suit your personal needs. If you know you’re a big spender or will have high rent and living costs, then a high overdraft account will probably be the best option, whereas an account with a higher interest rate on savings will be better if you know you’ll have some extra cash sitting in your account.